alameda county property tax calculator

Many vessel owners will see an increase in their 2022 property tax valuations. The mailing address is.

The valuation factors calculated by the State Board of Equalization and.

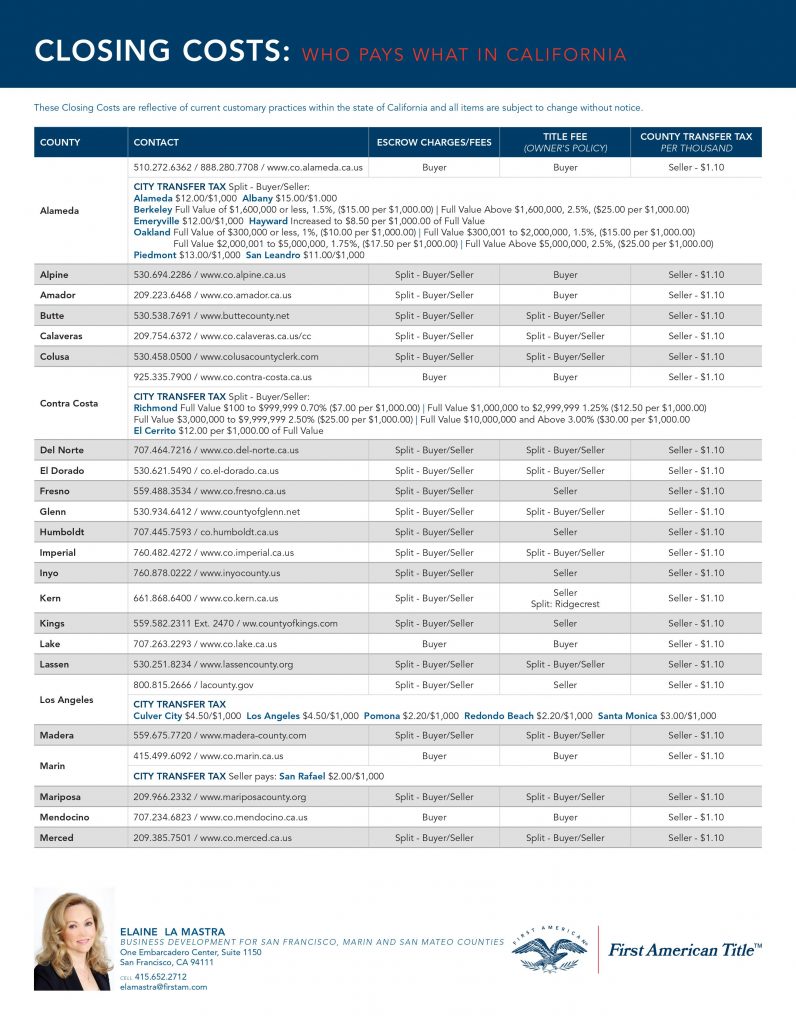

. Enter your Home Price and Down Payment in the. Any real estate owner can question a real property tax assessment. If you have to go to court you may need service of one of the best property tax attorneys in Alameda County CA.

The system may be temporarily unavailable due to system maintenance and nightly processing. If you have atypical situations or have additional questions about supplemental assessments please call the Assessors Office at 510 272-3787. 1221 Oak Street Room 131.

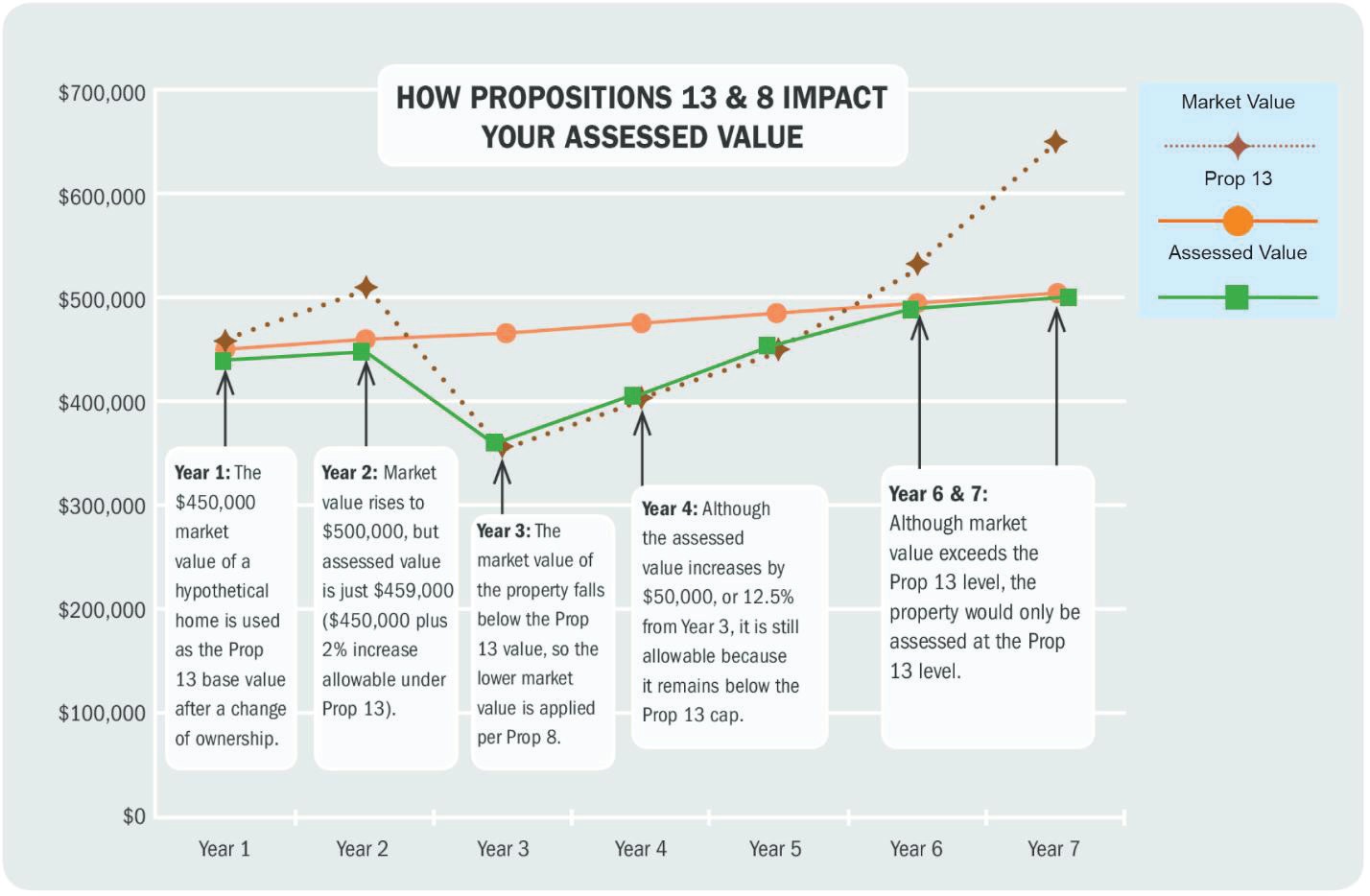

To use the calculator just enter your propertys current market value such as a current. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Dear Alameda County Residents.

Alameda County in California has a tax rate of 925 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in. Many vessel owners will see an increase in their 2022 property tax valuations. Lookup or pay delinquent prior year taxes for or earlier.

Alameda County Treasurer-Tax Collector. If you have atypical situations or have additional. The valuation factors calculated by the State Board of Equalization and.

Alameda County Sales Tax Rates for 2022. Dear Alameda County Residents. A convenience fee of 25 will be charged for a credit card.

This generally occurs Sunday. Dear Alameda County Residents. The median property tax in Alameda County California is 3993 per year for a home worth the median value of 590900.

You can pay online by credit card or by electronic check from your checking or savings account. The valuation factors calculated by the State Board of. To use the Supplemental Tax Estimator.

Many vessel owners will see an increase in their 2022 property tax valuations. For comparison the median home value in Alameda County is. The valuation factors calculated by the State Board of Equalization and.

Alameda county property tax calculator Wednesday October 26 2022 Edit. You can mail in a check and make it payable to Treasurer-Tax Collector Alameda County. Alameda county property tax calculator Wednesday October 26 2022 Edit.

Dear Alameda County Residents. Click on the map to expand. Enter your Home Price and Down Payment in the.

Many vessel owners will see an increase in their 2022 property tax valuations. This map shows property tax in correlation with square footage of the property. Use this Alameda County California Mortgage Calculator to estimate your monthly mortgage payment including taxes and insurance.

The median property tax also known as real estate tax in Alameda County is 399300 per year based on a median home value of 59090000 and a median effective property tax rate of. Pay Your Property Taxes Online. Alameda County collects on average 068 of a propertys.

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Tax Information Alameda Free Library

Good News For Homeowners Property Taxes Will Barely Go Up In 2014 The Mercury News

San Diego County Ca Property Tax Faq S In 2022 2023

Freestone County Texas Property Taxes 2022

Sewer Service Charges Union Sanitary District

Tax Guide Best City To Buy Legal Weed In California Leafly

Property Taxes Department Of Tax And Collections County Of Santa Clara

Alameda County Ca Property Tax Calculator Smartasset

Property Tax Calculator Tax Rates Org

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Property Tax Calculator Casaplorer

Alameda County Property Tax 2022 Ultimate Guide To Alameda County Oakland Property Tax Rates Search Payments Dates

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

Property Taxes Lookup Alameda County S Official Website

Claim For Reassessment Exclusion For Transfer Between Parent And Child Ccsf Office Of Assessor Recorder